+971 4 88 33 661

[email protected]

Street N306, Jebel Ali Free Zone, Dubai, UAE

+971 4 88 33 661

+971 4 88 33 661 [email protected]

[email protected] Street N306, Jebel Ali Free Zone, Dubai, UAE

Street N306, Jebel Ali Free Zone, Dubai, UAE

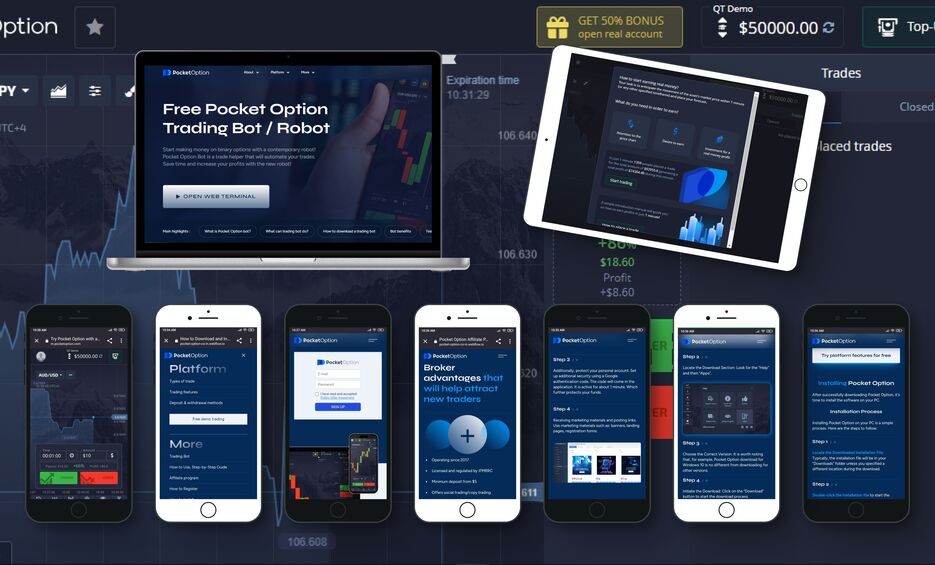

Engaging in online trading can be an exciting venture, particularly with platforms like pocket option taxes Pocket Option. However, with the thrill of trading comes the responsibility of understanding tax obligations. This article aims to delve into the complexities of Pocket Option taxes, helping you navigate your reporting requirements, obligations, and best practices associated with online trading. We will clarify the principles behind taxation in the realm of digital trading, ensuring you can manage your financial responsibilities effectively while enjoying the benefits of trading.

When you engage in trading through platforms like Pocket Option, you’re entering a domain that the tax authorities closely monitor. The first step is to grasp what taxes you are liable for depending on your jurisdiction. Generally, taxes on trading profits fall under capital gains tax. This tax applies to gains made from selling investments, including forex, stocks, and other securities you might trade on Pocket Option.

Capital gains tax is imposed on the profit made from the sale of an asset. In simple terms, if you buy a financial instrument for one price and sell it for a higher price, the profit you make is your capital gain—and it’s subject to taxation. The rate at which you are taxed on your capital gains can differ based on how long you held the asset before selling it. In many jurisdictions, short-term capital gains (assets held for less than a year) are taxed at your regular income tax rate, while long-term capital gains (assets held for longer than a year) are usually taxed at a lower rate.

Tax reporting can be daunting, but understanding what you need to report is crucial. In most cases, if you realize a capital gain from your trading activities on Pocket Option, you are required to report it on your tax return. This includes both realized gains (profits from sold positions) and sometimes unrealized gains, depending on your local laws. It’s important to maintain accurate records of your trades, including:

Tax treatment for online traders varies significantly across countries. For instance:

Understanding the deductions available can significantly reduce your taxable income. Common deductions for traders include:

Research the specific rules in your jurisdiction to ensure you maximize your deductions legally.

Here are some effective strategies for managing your Pocket Option trading records:

Navigating the tax implications of your trading activities on platforms like Pocket Option can be complex. Knowing the rules, maintaining accurate records, and leveraging deductions can make a significant difference in your tax liabilities. Take the time to educate yourself about your obligations and consider seeking professional assistance to ensure compliance with tax regulations in your area. By doing so, you can focus more on your trading strategy and less on the stress of tax season.

Ultimately, being proactive and organized in managing your taxes will not only save you money but also allow you to make the most out of your trading experience. Whether you’re a novice or a seasoned trader, understanding Pocket Option taxes and how they apply to you is an integral part of your trading journey.

We are focused on building a long-term, sustainable business.

Read More